AEON Personal Loan Table, Unlock Financial Flexibility

Discover the financial possibilities with AEON Personal Loans. Get up to RM100,000, fast approval, and flexible repayment options. Explore the AEON Personal Loan Table now.

In today's fast-paced world, financial flexibility and stability are paramount. Whether you need funds for school fees, starting a business, or covering medical costs, AEON Personal Loans are here to empower you.

With financing options of up to RM100,000, low monthly repayments starting from just RM55, and repayment tenures of up to 7 years, AEON Personal Loans offer a reliable solution for your financial needs.

In this

article, we'll explore the key features and benefits of AEON Personal Loans,

helping you understand how they can make a difference in your life.

Features & Benefits AEON Personal Loan

Fast Approval

One of the standout features of AEON Personal

Loans is their fast approval process. Need cash urgently, even on a Sunday?

AEON has got you covered.

High Financing Amount

AEON Personal Loans offer financing of

up to RM100,000, ensuring you have the resources you need for various purposes.

Attractive Rates

With interest rates as low as 0.66% per

month, AEON Personal Loans provide cost-effective financing solutions.

Flexible Repayment Tenure

Choose a repayment tenure that

suits your financial situation. Options range from 6 to 84 months, giving you

the flexibility to plan your repayments.

Simple Documents

AEON makes the application process

hassle-free. You only need to prepare the necessary documents to get started.

Hassle-Free

No guarantor, no collateral, and no security

deposit required. AEON Personal Loans prioritize your convenience.

Shariah-Compliant

AEON Personal Loans operate based on the

Shariah concept of Tawarruq, ensuring ethical and transparent financial

transactions.

Requirements

Eligibility

To be eligible for AEON Personal Loans, you must be a Malaysian citizen aged between 18 and 65, with a minimum gross income of RM1,500. The loan amount can vary from RM1,000 to a maximum of RM100,000.

Documents Needed

Here are the documents you'll need to

initiate the application process:

- Valid Email Address and Mobile Number: Essential for verification purposes.

- Verification Code: A code will be sent for verification to complete your application.

Fees & Charges

Processing Fee

The processing fee is 4% of the financing amount for loans up to RM10,000 and 2% for amounts exceeding RM10,000. The maximum fee is capped at RM400.

Stamp Duty

Stamp duty fees follow the Stamp Act 1949

(Revised 1989).

Wakalah Fee

A fee of RM10.60, inclusive of 6% SST (Sales and

Service Tax), is applicable.

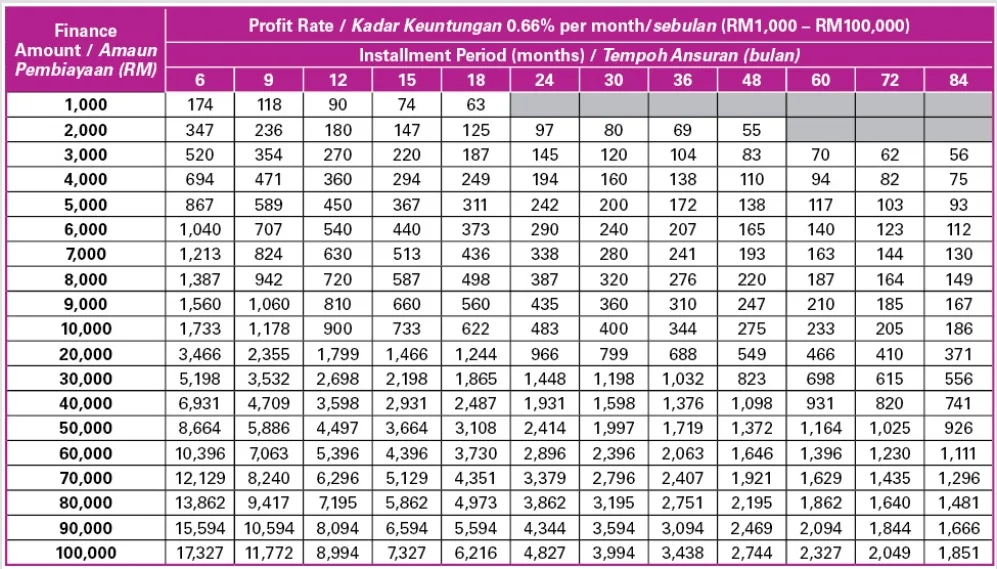

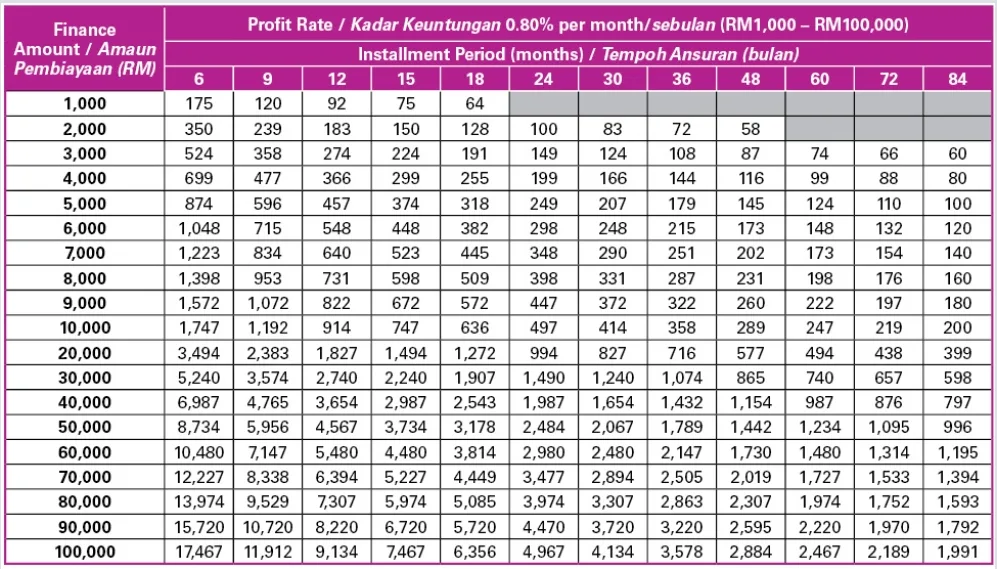

AEON Personal Loan Table

Instalment Tables (RM1,000 – RM100,000): (Note: The actual financed amount may vary from the tables below.)

How to Apply

Are you eager to apply for an AEON Personal Loan and make

the most of their financial services? We've got you covered with a step-by-step

guide on how to complete your application on their official website: AEON Personal Loan

Application Portal.

Start by accessing the official AEON Personal Loan

application portal by clicking on the following link: https://pfapply.aeoncredit.com.my/.

Step 2: Select Your Preferred Language

Upon reaching the portal, you'll have the option to choose

your preferred language for the application process. AEON offers both English

and Bahasa Malaysia for your convenience.

Step 3: Begin Your Application

Click on the "Start Application" or equivalent

button to initiate your AEON Personal Loan application.

Step 4: Personal Details

You'll be asked to provide essential personal details,

including your name, contact information, and identification details. Ensure

that all the information you provide is accurate.

Step 5: Income Information

AEON needs to understand your financial situation to offer

you the best loan options. Share details about your income, employment status,

and monthly earnings.

Step 6: Loan Preferences

Specify the loan amount you require and the preferred

repayment tenure. AEON provides flexible options to suit your financial needs.

Step 7: Document Submission

Upload the necessary documents as per AEON's requirements.

These typically include your identification documents, proof of income, and any

additional documents they may request.

Step 8: Review and Confirm

Carefully review all the information you've provided to

ensure its accuracy. Once you're satisfied, proceed to confirm your

application.

Step 9: Verification and Approval

AEON will review your application and may contact you for

any additional information or clarification. The approval process is typically

fast, and you may even receive your funds on a Sunday, as mentioned in the

benefits section.

Step 10: Loan Disbursement

Upon approval, AEON will disburse the loan amount to your

specified bank account, allowing you to access the funds you need for your

financial goals.

Step 11: Repayment Setup

Once your loan is disbursed, you'll need to set up the

repayment schedule according to your chosen tenure. AEON offers various options

to make repayments convenient for you.

Step 12: Enjoy Your Financial Freedom

With your AEON Personal Loan secured and funds at your

disposal, you can now take control of your financial needs, whether it's paying

school fees, starting a business, or managing medical expenses.

Remember that the application process may evolve, and AEON may introduce new features or requirements. Therefore, it's always a good practice to check their official website for the most up-to-date information and guidance on applying for an AEON Personal Loan.

Conclusion

AEON Personal Loans offer a lifeline when you need financial support the most. With a wide range of financing options, low-interest rates, and a straightforward application process, AEON makes your financial journey stress-free.

Whether you're aiming to cover education expenses, kickstart a business, or manage medical bills, AEON Personal Loans are your trusted partner.

Explore the AEON Personal Loan Table and unlock a world of financial possibilities. Visit AEON's official website for more details and start your journey toward financial freedom today.

Post a Comment for "AEON Personal Loan Table, Unlock Financial Flexibility"